Uber has always been walking a thin employment line.

Are Uber drivers employees? Or are they independent contractors?

Last week, it was revealed that the California Labor Commission ruled that an Uber driver was an employee, not an independent contractor.

That, of course, meant Uber had to fork over some cash to that driver.

Uber has long argued that their drivers are independent contractors. And some courts have agreed.

We’ll hand it to them: they don’t make their drivers wear company shirts or tell them when they have to work (which are markings of an employer/employee relationship).

But this court argued several reasons why Uber drivers are employees. Uh oh!

It’s unclear what affect this will have on Uber. They’ve appealed. And it is just one driver at this point. But it could be big trouble for the company if this sets a precedent.

While we wait to find out what happens, we thought this would be the perfect time to review the difference between employee & independent contractor, and why you should know the difference.

Why it matters as a business owner:

As a business owner, it’s important to make sure you properly classify those who work for you. Why?

Well, for one, you can be at risk for labor law violations if your workers are misclassified.

Also, a lot of it boils down to taxes.

You see, employers are required to withhold certain taxes on wages from employees, but generally don’t have to on wages to independent contractors.

Therefore, if you misclassify an employee as an independent contractor, you could be liable for employment taxes on the worker.

Not to mention, employees are entitled to government-mandated social security, workers’ compensation and unemployment insurance, and independent contractors aren’t. (And you definitely don’t want a lawsuit over this like the one Uber got.)

That’s why — for one example — Uber is concerned about the California ruling. If it sets precedent, and they must classify drivers as employees, Uber could face much higher costs to pay for these for their drivers.

How you can determine status:

The IRS has three “rules” to help you determine your workers’ statuses.

The IRS’ Common Law Rules, as stated on their website, are:

- Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job?

- Financial: Are the business aspects of the worker’s job controlled by the payer? (these include things like how worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

- Type of Relationship: Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?

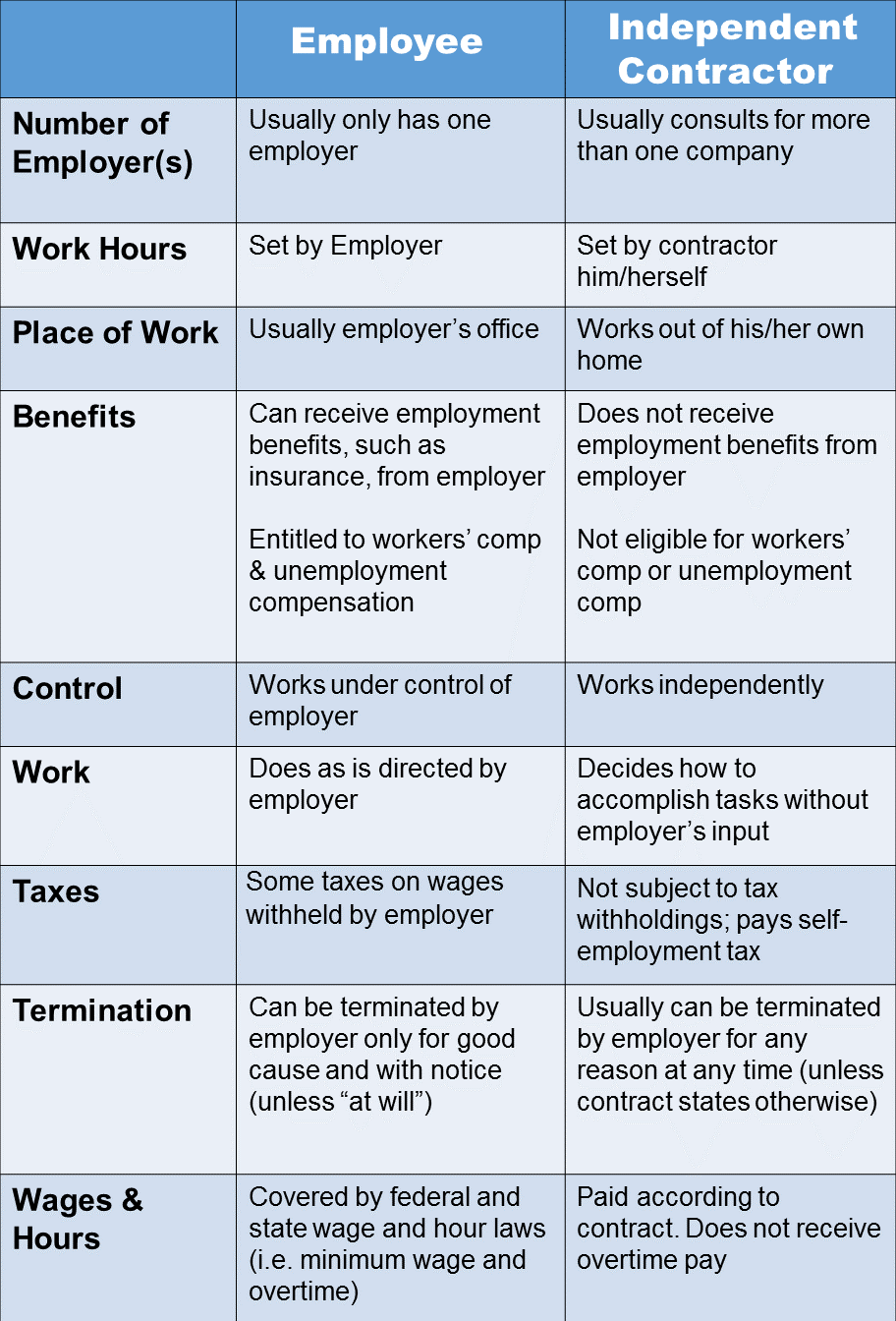

Some of these answers point to employee status and some to an independent contractor, so let’s explore some of the characteristics of both:

Source: employment.findlaw.com

Of course, these are just a few examples, and there are other ways employees and independent contractors can differ. If you need help with this HR headache or any other employee issue, we can help.

Oh, and if you’re curious, the California Labor Commission argued “control” is the main reason Uber’s workers are employees. They said Uber is “involved in every aspect of the operation,” including controlling transactions made through the app and terminating driver’s access to the system if their ratings fall below 4.6 stars.